Founded in 1954, BKF Capital Group, Inc. (OTC: BKFG), is a publicly traded company operating through its wholly-owned subsidiaries, BKF Asset Holdings, Inc, which invests in publicly and privately owned businesses.

BKF's Current Holdings

Interlink Electronics, Inc.® (Nasdaq: LINK), a full-service technology partner and leading provider of sensing and HMI solutions. Since introducing the Force Sensing Resistor (FSR®) to market 35 years ago, Interlink has maintained a track record of innovation and manufacturing excellence supported by its vertically-integrated, in-house capabilities. Interlink has made significant investments in R&D and product development, demonstrating its commitment to diversifying its product line, expanding into new markets, and growing its global partner channels. Focused on expanding as a diversified high-growth technology and industrial leader, Interlink is pursuing acquisitions within the following four sectors: Sensors, Test & Measurement, Engineering Services, and Specialty Components/Solutions Manufacturers.

Qualstar Corp.® (OTC: QBAK), founded in 1984, is a diversified electronics manufacturer specializing in data storage and power supplies. It is a leader in tape backup solutions, producing scalable automated libraries and drives to satisfy a spectrum of needs ranging from those of individual customers all the way to enterprise applications.

Management Team & Board of Directors

|

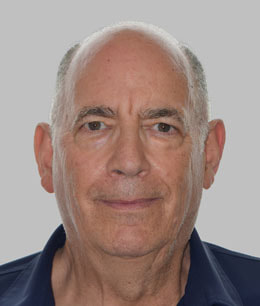

Steven N. Bronson, Chairman, President & CEO / Board Member

Mr. Steven N. Bronson has over 40 years of business and entrepreneurial experience. His successful background in investment banking and principal investing has led to him taking executive positions in several companies. Mr. Bronson has held the position of Chairman, President, and CEO of BKF Capital Group, Inc. (OTC: BKFG) since October 2008. Founded in 1954, BKF Capital Group is a publicly traded company operating through its wholly owned subsidiaries. In July 2013, Mr. Bronson assumed the positions of President and CEO of Qualstar Corporation (OTC: QBAK), a high quality tape library manufacturer and data storage solutions provider, and its subsidiary N2Power, a manufacturer of high efficiency power supplies for diverse electronics industries. He immediately initiated a turnaround strategy, implementing cost cutting measures and aggressive sales efforts that are fundamental steps towards profitability. Mr. Bronson became the CEO and Chairman of Interlink Electronics, Inc. (Nasdaq: LINK) in July of 2010. In March of 2011, he also took on the role of President, bringing both his operational and financial expertise to the company. Since successfully turning around Interlink's business to profitability, Mr. Bronson has focused on strategic matters, mission-critical decisions, and the identification of potential acquisitions and business partnership opportunities. From 1996 until November 2014, Mr. Bronson founded Bronson & Co and served as CEO and Chairman. Bronson & Co., LLC is an investment banking firm that assists private, public, emerging growth, and middle market companies with raising capital, advisory services, and mergers and acquisitions. In addition, Mr. Bronson sat on the board of Mikron Infrared Instruments, Inc. (Nasdaq: MIKR) from September 1996 to July 2000. During a restructuring period from August 1998 to May 1999, he served as Mikron's Chairman and CEO. Mr. Bronson led the effort of recruiting a top-notch management team, eventually increasing the company's revenue by 500 percent. The company was sold in April 2007 to LumaSense Technologies, Inc., an Advanced Energy company (Nasdaq: AEIS). Mr. Bronson currently holds the Series 4, 7, 24, 27, 53, 55, and 79 licenses (inactive). Mr. Bronson is also the Chairman, President, and Chief Executive Officer of Ridgefield Acquisition Corp. (OTC: RDGA) since 1996. Ridgefield Acquisition Corp. is a public shell that is seeking a merger, acquisition, or business combination with a viable operating entity. |

|

Leonard A. Hagan, Secretary / Board Member

Mr. Hagan is a founding partner at Hagan & Burns CPA’s P.C. where he provides financial and regulatory services to the broker-dealer community as well as tax preparation services to the firm’s clients. Prior to founding Hagan & Burns in 1995, Mr. Hagan worked for six years at the accounting firm of S.D. Leidesdorf & Co. where he was a manager, which was then merged into Ernst & Whinney. Following his time at S.D. Leidesdorf & Co. and Ernst & Whinney, Mr. Hagan spent three years at Credit Suisse until he founded his own accounting firm. Mr. Hagan has over forty-five years’ experience as a certified public accountant and over twenty-five years as a licensed Financial and Operations Principal.

Mr. Hagan earned a Bachelor of Arts degree in Economics from Ithaca College and continued his education at Cornell University where he received his MBA in accounting and finance. Mr. Hagan is also a director of Ridgefield Acquisition Corp. (OTCMKTS: RDGA), which is a publicly traded company. |

|

Ryan J. Hoffman, Chief Financial Officer

Ryan J. Hoffman brings a wealth of skills and expertise to BKF Capital. He comes with more than two decades of auditing and professional experience from two top global accounting firms. As CFO, he is a key member of the company’s executive team, managing financial strategy, overseeing all financial functions, corporate development, and acquisitions. His familiarity with managing multinational projects will be vital as BKF Capital continues to grow. Before coming to BKF, Ryan spent 16 years at the accounting firm RSM and was a partner at the company for his last five years. There, he successfully led audits of global companies in industries that include technology, consumer products, and manufacturing. While there, he cultivated a specialization in software and multiple-element revenue recognition accounting and auditing. Prior to that, he worked for the Big Four accounting firm Ernst & Young. Mr. Hoffman graduated with a degree in accounting from Chapman University and is a licensed CPA (inactive). |